ErieIndemnity ERIE full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSIErie Indemnity ERIE WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI USA stock exchange

operates under Finance sector & deals in Specialty Insurers

Daily price and charts and targets ErieIndemnity Strong Daily Stock price targets for ErieIndemnity ERIE are 298 and 302.93 | Daily Target 1 | 294.11 | | Daily Target 2 | 296.95 | | Daily Target 3 | 299.04333333333 | | Daily Target 4 | 301.88 | | Daily Target 5 | 303.97 |

Daily price and volume Erie Indemnity

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

299.78 (1.21%) |

297.51 |

296.21 - 301.14 |

0.7964 times |

Wed 03 December 2025 |

296.21 (0.09%) |

295.88 |

294.10 - 299.34 |

0.6813 times |

Tue 02 December 2025 |

295.95 (0.75%) |

293.90 |

292.74 - 297.28 |

1.0613 times |

Mon 01 December 2025 |

293.76 (-0.59%) |

294.84 |

292.47 - 297.12 |

1.1347 times |

Fri 28 November 2025 |

295.49 (0.42%) |

295.61 |

293.96 - 297.03 |

0.4424 times |

Wed 26 November 2025 |

294.24 (-0.47%) |

294.68 |

294.24 - 298.02 |

0.6947 times |

Tue 25 November 2025 |

295.63 (1.27%) |

294.73 |

294.68 - 298.79 |

0.7885 times |

Mon 24 November 2025 |

291.92 (-1.5%) |

295.17 |

291.59 - 297.43 |

1.7379 times |

Fri 21 November 2025 |

296.36 (1.13%) |

293.17 |

293.17 - 301.61 |

1.3452 times |

Thu 20 November 2025 |

293.06 (2.81%) |

285.77 |

285.68 - 294.38 |

1.3176 times |

Wed 19 November 2025 |

285.06 (-1.76%) |

289.18 |

282.91 - 292.04 |

1.2585 times |

Weekly price and charts ErieIndemnity Strong weekly Stock price targets for ErieIndemnity ERIE are 296.13 and 304.8 | Weekly Target 1 | 289.13 | | Weekly Target 2 | 294.45 | | Weekly Target 3 | 297.79666666667 | | Weekly Target 4 | 303.12 | | Weekly Target 5 | 306.47 |

Weekly price and volumes for Erie Indemnity

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

299.78 (1.45%) |

294.84 |

292.47 - 301.14 |

0.7491 times |

Fri 28 November 2025 |

295.49 (-0.29%) |

295.17 |

291.59 - 298.79 |

0.747 times |

Fri 21 November 2025 |

296.36 (3.41%) |

288.44 |

282.91 - 301.61 |

1.2168 times |

Fri 14 November 2025 |

286.58 (0.61%) |

283.77 |

276.91 - 293.69 |

1.1362 times |

Fri 07 November 2025 |

284.84 (-2.67%) |

286.70 |

279.78 - 290.88 |

0.9357 times |

Fri 31 October 2025 |

292.64 (0%) |

315.64 |

282.01 - 320.50 |

0.5923 times |

Fri 31 October 2025 |

292.64 (-9.87%) |

324.99 |

282.01 - 330.54 |

1.8945 times |

Fri 24 October 2025 |

324.67 (2.53%) |

317.48 |

313.49 - 328.15 |

0.9306 times |

Fri 17 October 2025 |

316.66 (-2.36%) |

324.59 |

306.84 - 325.02 |

0.9475 times |

Fri 10 October 2025 |

324.31 (1.61%) |

317.45 |

313.73 - 329.75 |

0.8504 times |

Fri 03 October 2025 |

319.16 (1%) |

315.99 |

306.80 - 324.56 |

0.8397 times |

Monthly price and charts ErieIndemnity Strong monthly Stock price targets for ErieIndemnity ERIE are 296.13 and 304.8 | Monthly Target 1 | 289.13 | | Monthly Target 2 | 294.45 | | Monthly Target 3 | 297.79666666667 | | Monthly Target 4 | 303.12 | | Monthly Target 5 | 306.47 |

Monthly price and volumes Erie Indemnity

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

299.78 (1.45%) |

294.84 |

292.47 - 301.14 |

0.1749 times |

Fri 28 November 2025 |

295.49 (0.97%) |

286.70 |

276.91 - 301.61 |

0.942 times |

Fri 31 October 2025 |

292.64 (-8.02%) |

318.32 |

282.01 - 330.54 |

1.3311 times |

Tue 30 September 2025 |

318.16 (-10.22%) |

355.11 |

310.19 - 355.11 |

1.0732 times |

Fri 29 August 2025 |

354.38 (-0.52%) |

356.53 |

346.00 - 380.67 |

1.0302 times |

Thu 31 July 2025 |

356.24 (2.72%) |

346.97 |

332.34 - 372.88 |

1.2501 times |

Mon 30 June 2025 |

346.79 (-3.27%) |

355.65 |

333.33 - 377.17 |

1.048 times |

Fri 30 May 2025 |

358.51 (-0.03%) |

359.60 |

343.76 - 374.21 |

0.9973 times |

Wed 30 April 2025 |

358.62 (-14.42%) |

417.18 |

344.49 - 434.00 |

1.2356 times |

Mon 31 March 2025 |

419.05 (-2.11%) |

426.28 |

404.66 - 456.93 |

0.9177 times |

Fri 28 February 2025 |

428.07 (6.23%) |

402.11 |

377.18 - 435.57 |

0.9375 times |

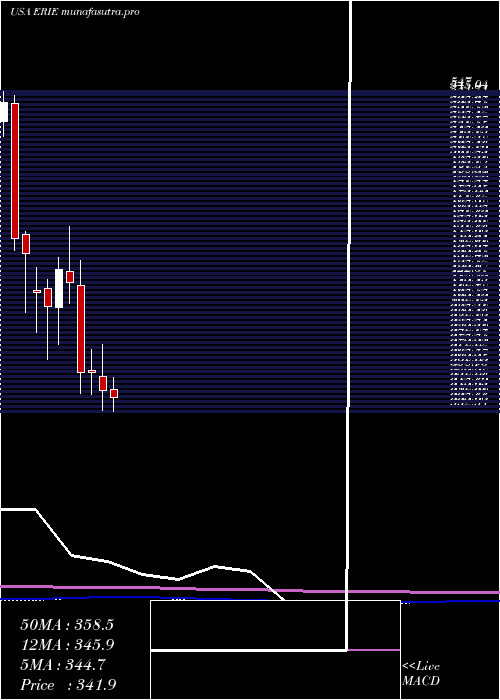

DMA SMA EMA moving averages of Erie Indemnity ERIE

DMA (daily moving average) of Erie Indemnity ERIE

| DMA period | DMA value | | 5 day DMA | 296.24 | | 12 day DMA | 293.97 | | 20 day DMA | 289.91 | | 35 day DMA | 299.05 | | 50 day DMA | 304.8 | | 100 day DMA | 326.25 | | 150 day DMA | 335.77 | | 200 day DMA | 354.1 | EMA (exponential moving average) of Erie Indemnity ERIE

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 296.69 | 295.15 | 294.62 | | 12 day EMA | 294.65 | 293.72 | 293.27 | | 20 day EMA | 295.02 | 294.52 | 294.34 | | 35 day EMA | 299.16 | 299.12 | 299.29 | | 50 day EMA | 305.05 | 305.26 | 305.63 |

SMA (simple moving average) of Erie Indemnity ERIE

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 296.24 | 295.13 | 295.01 | | 12 day SMA | 293.97 | 292.93 | 292.13 | | 20 day SMA | 289.91 | 289.33 | 288.99 | | 35 day SMA | 299.05 | 299.59 | 300.3 | | 50 day SMA | 304.8 | 305.09 | 305.51 | | 100 day SMA | 326.25 | 326.67 | 327.18 | | 150 day SMA | 335.77 | 336.16 | 336.56 | | 200 day SMA | 354.1 | 354.54 | 355.03 |

|

|