CabotCorporation CBT full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSICabot Corporation CBT WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI USA stock exchange

operates under Basic Industries sector & deals in Major Chemicals

Daily price and charts and targets CabotCorporation Strong Daily Stock price targets for CabotCorporation CBT are 70.69 and 71.91 | Daily Target 1 | 69.76 | | Daily Target 2 | 70.4 | | Daily Target 3 | 70.976666666667 | | Daily Target 4 | 71.62 | | Daily Target 5 | 72.2 |

Daily price and volume Cabot Corporation

| Date |

Closing |

Open |

Range |

Volume |

Tue 21 October 2025 |

71.05 (0.62%) |

70.48 |

70.33 - 71.55 |

0.621 times |

Mon 20 October 2025 |

70.61 (1.38%) |

69.97 |

69.56 - 70.66 |

0.5673 times |

Fri 17 October 2025 |

69.65 (0.77%) |

69.10 |

68.67 - 69.74 |

0.7856 times |

Thu 16 October 2025 |

69.12 (0.98%) |

68.60 |

67.68 - 69.58 |

1.118 times |

Wed 15 October 2025 |

68.45 (0.53%) |

68.58 |

68.03 - 69.62 |

1.3304 times |

Tue 14 October 2025 |

68.09 (-2.14%) |

68.06 |

66.50 - 68.30 |

1.9463 times |

Mon 13 October 2025 |

69.58 (0.58%) |

69.97 |

69.56 - 70.92 |

0.7978 times |

Fri 10 October 2025 |

69.18 (-2.89%) |

71.79 |

69.05 - 71.95 |

1.1878 times |

Thu 09 October 2025 |

71.24 (-2.45%) |

73.22 |

71.07 - 73.22 |

1.0637 times |

Wed 08 October 2025 |

73.03 (-0.5%) |

73.82 |

72.59 - 73.82 |

0.5822 times |

Tue 07 October 2025 |

73.40 (-2.77%) |

75.39 |

73.09 - 75.77 |

1.2767 times |

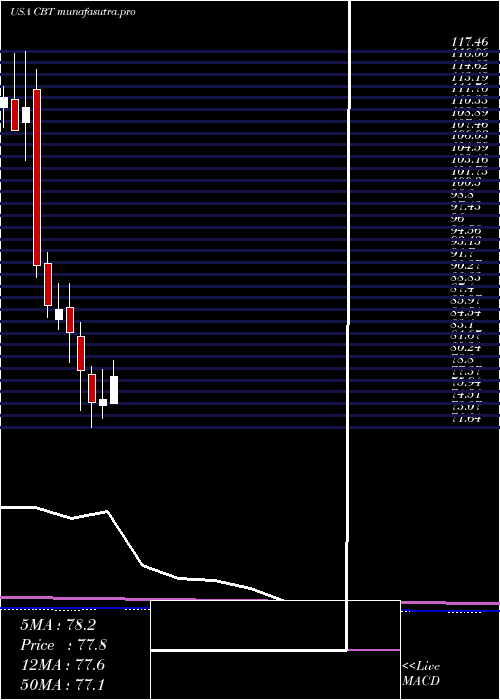

Weekly price and charts CabotCorporation Strong weekly Stock price targets for CabotCorporation CBT are 70.31 and 72.3 | Weekly Target 1 | 68.73 | | Weekly Target 2 | 69.89 | | Weekly Target 3 | 70.72 | | Weekly Target 4 | 71.88 | | Weekly Target 5 | 72.71 |

Weekly price and volumes for Cabot Corporation

| Date |

Closing |

Open |

Range |

Volume |

Tue 21 October 2025 |

71.05 (2.01%) |

69.97 |

69.56 - 71.55 |

0.369 times |

Fri 17 October 2025 |

69.65 (0.68%) |

69.97 |

66.50 - 70.92 |

1.8566 times |

Fri 10 October 2025 |

69.18 (-7.97%) |

75.34 |

69.05 - 76.05 |

1.3769 times |

Fri 03 October 2025 |

75.17 (-2.67%) |

77.56 |

74.89 - 77.56 |

1.0262 times |

Fri 26 September 2025 |

77.23 (-0.36%) |

77.10 |

74.81 - 77.90 |

1.1352 times |

Fri 19 September 2025 |

77.51 (-1.89%) |

79.41 |

76.62 - 80.37 |

1.3449 times |

Fri 12 September 2025 |

79.00 (-2.53%) |

80.80 |

78.94 - 81.72 |

1.0431 times |

Fri 05 September 2025 |

81.05 (-0.63%) |

80.34 |

79.61 - 82.80 |

0.7465 times |

Fri 29 August 2025 |

81.56 (0%) |

81.67 |

80.81 - 82.35 |

0.2283 times |

Fri 29 August 2025 |

81.56 (-1.66%) |

82.20 |

80.72 - 82.58 |

0.8734 times |

Fri 22 August 2025 |

82.94 (6.13%) |

77.87 |

77.87 - 83.71 |

1.0734 times |

Monthly price and charts CabotCorporation Strong monthly Stock price targets for CabotCorporation CBT are 63.47 and 74.08 | Monthly Target 1 | 60.94 | | Monthly Target 2 | 66 | | Monthly Target 3 | 71.553333333333 | | Monthly Target 4 | 76.61 | | Monthly Target 5 | 82.16 |

Monthly price and volumes Cabot Corporation

| Date |

Closing |

Open |

Range |

Volume |

Tue 21 October 2025 |

71.05 (-6.57%) |

75.60 |

66.50 - 77.11 |

0.7771 times |

Tue 30 September 2025 |

76.05 (-6.76%) |

80.34 |

74.81 - 82.80 |

0.8774 times |

Fri 29 August 2025 |

81.56 (13%) |

71.39 |

70.40 - 83.71 |

1.001 times |

Thu 31 July 2025 |

72.18 (-3.76%) |

74.57 |

70.96 - 79.76 |

0.91 times |

Mon 30 June 2025 |

75.00 (0.42%) |

74.31 |

72.71 - 78.62 |

0.9207 times |

Fri 30 May 2025 |

74.69 (-4.9%) |

78.08 |

71.64 - 79.07 |

1.3121 times |

Wed 30 April 2025 |

78.54 (-5.53%) |

82.70 |

73.63 - 84.44 |

1.1105 times |

Mon 31 March 2025 |

83.14 (-3.33%) |

86.27 |

79.57 - 89.15 |

1.0156 times |

Fri 28 February 2025 |

86.00 (-0.54%) |

84.81 |

83.60 - 89.16 |

1.1402 times |

Fri 31 January 2025 |

86.47 (-5.3%) |

91.63 |

85.04 - 92.89 |

0.9353 times |

Tue 31 December 2024 |

91.31 (-17.43%) |

112.83 |

89.91 - 115.16 |

0.7642 times |

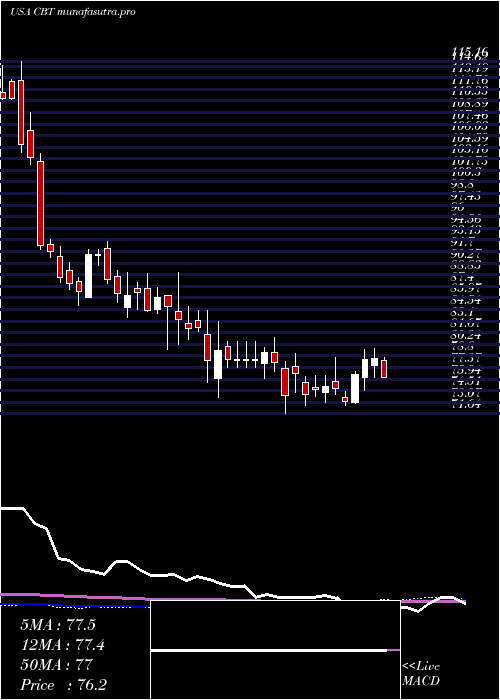

DMA SMA EMA moving averages of Cabot Corporation CBT

DMA (daily moving average) of Cabot Corporation CBT

| DMA period | DMA value | | 5 day DMA | 69.78 | | 12 day DMA | 70.74 | | 20 day DMA | 72.79 | | 35 day DMA | 75.47 | | 50 day DMA | 77.03 | | 100 day DMA | 76.55 | | 150 day DMA | 77.11 | | 200 day DMA | 79.52 | EMA (exponential moving average) of Cabot Corporation CBT

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 70.26 | 69.86 | 69.49 | | 12 day EMA | 71.05 | 71.05 | 71.13 | | 20 day EMA | 72.4 | 72.54 | 72.74 | | 35 day EMA | 74.36 | 74.55 | 74.78 | | 50 day EMA | 76.35 | 76.57 | 76.81 |

SMA (simple moving average) of Cabot Corporation CBT

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 69.78 | 69.18 | 68.98 | | 12 day SMA | 70.74 | 71.08 | 71.5 | | 20 day SMA | 72.79 | 73.06 | 73.35 | | 35 day SMA | 75.47 | 75.75 | 76.07 | | 50 day SMA | 77.03 | 77.17 | 77.28 | | 100 day SMA | 76.55 | 76.58 | 76.64 | | 150 day SMA | 77.11 | 77.19 | 77.28 | | 200 day SMA | 79.52 | 79.61 | 79.7 |

|

|