NokiaCorporation NOK full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSINokia Corporation NOK WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NYSE stock exchange

operates under Technology sector & deals in Radio And Television Broadcasting And Communications Equipment

Daily price and charts and targets NokiaCorporation Strong Daily Stock price targets for NokiaCorporation NOK are 6.08 and 6.23 | Daily Target 1 | 6.05 | | Daily Target 2 | 6.11 | | Daily Target 3 | 6.2033333333333 | | Daily Target 4 | 6.26 | | Daily Target 5 | 6.35 |

Daily price and volume Nokia Corporation

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

6.16 (-1.6%) |

6.26 |

6.15 - 6.30 |

0.4579 times |

Wed 03 December 2025 |

6.26 (1.13%) |

6.18 |

6.15 - 6.28 |

0.9034 times |

Tue 02 December 2025 |

6.19 (1.14%) |

6.16 |

6.14 - 6.23 |

0.5792 times |

Mon 01 December 2025 |

6.12 (0.66%) |

6.16 |

6.11 - 6.18 |

0.6539 times |

Fri 28 November 2025 |

6.08 (0%) |

6.07 |

6.03 - 6.11 |

0.4695 times |

Wed 26 November 2025 |

6.08 (0.33%) |

6.02 |

5.99 - 6.13 |

0.8658 times |

Tue 25 November 2025 |

6.06 (-0.49%) |

6.05 |

6.03 - 6.13 |

1.0651 times |

Mon 24 November 2025 |

6.09 (2.53%) |

5.95 |

5.90 - 6.09 |

1.0773 times |

Fri 21 November 2025 |

5.94 (1.19%) |

5.96 |

5.89 - 6.04 |

1.7622 times |

Thu 20 November 2025 |

5.87 (-2.65%) |

6.18 |

5.86 - 6.21 |

2.1657 times |

Wed 19 November 2025 |

6.03 (-9.32%) |

6.24 |

5.98 - 6.24 |

3.1918 times |

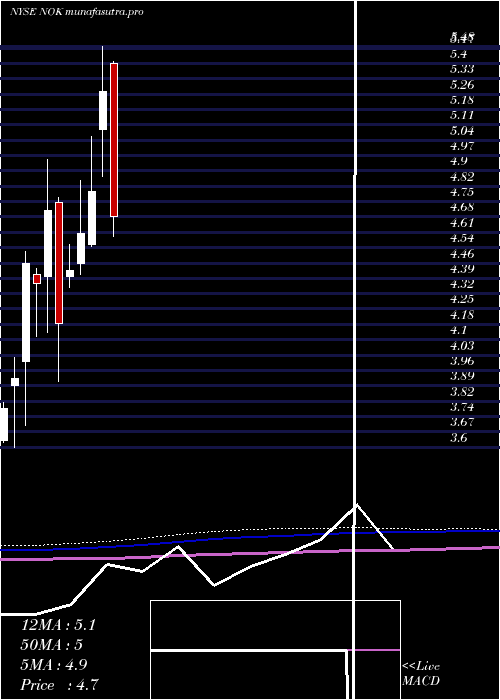

Weekly price and charts NokiaCorporation Strong weekly Stock price targets for NokiaCorporation NOK are 6.07 and 6.26 | Weekly Target 1 | 6 | | Weekly Target 2 | 6.08 | | Weekly Target 3 | 6.19 | | Weekly Target 4 | 6.27 | | Weekly Target 5 | 6.38 |

Weekly price and volumes for Nokia Corporation

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

6.16 (1.32%) |

6.16 |

6.11 - 6.30 |

0.2958 times |

Fri 28 November 2025 |

6.08 (2.36%) |

5.95 |

5.90 - 6.13 |

0.3965 times |

Fri 21 November 2025 |

5.94 (-11.74%) |

6.72 |

5.86 - 6.77 |

1.1592 times |

Fri 14 November 2025 |

6.73 (-1.61%) |

6.88 |

6.57 - 7.23 |

0.9456 times |

Fri 07 November 2025 |

6.84 (-1.01%) |

7.01 |

6.60 - 7.18 |

0.6412 times |

Fri 31 October 2025 |

6.91 (0%) |

6.98 |

6.78 - 6.98 |

0.418 times |

Fri 31 October 2025 |

6.91 (9.68%) |

6.34 |

6.33 - 8.19 |

3.4783 times |

Fri 24 October 2025 |

6.30 (9.76%) |

5.72 |

5.45 - 6.34 |

1.3454 times |

Fri 17 October 2025 |

5.74 (13.21%) |

5.27 |

5.19 - 5.79 |

1.0127 times |

Tue 07 October 2025 |

5.07 (3.47%) |

4.88 |

4.87 - 5.09 |

0.3073 times |

Fri 03 October 2025 |

4.90 (5.15%) |

4.68 |

4.66 - 4.92 |

0.8285 times |

Monthly price and charts NokiaCorporation Strong monthly Stock price targets for NokiaCorporation NOK are 6.07 and 6.26 | Monthly Target 1 | 6 | | Monthly Target 2 | 6.08 | | Monthly Target 3 | 6.19 | | Monthly Target 4 | 6.27 | | Monthly Target 5 | 6.38 |

Monthly price and volumes Nokia Corporation

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

6.16 (1.32%) |

6.16 |

6.11 - 6.30 |

0.1222 times |

Fri 28 November 2025 |

6.08 (-12.01%) |

7.01 |

5.86 - 7.23 |

1.2984 times |

Fri 31 October 2025 |

6.91 (43.66%) |

4.80 |

4.74 - 8.19 |

2.8811 times |

Tue 30 September 2025 |

4.81 (11.86%) |

4.28 |

4.23 - 4.88 |

1.252 times |

Fri 29 August 2025 |

4.30 (5.39%) |

4.05 |

4.00 - 4.36 |

0.6245 times |

Thu 31 July 2025 |

4.08 (-21.24%) |

5.16 |

4.06 - 5.24 |

0.9627 times |

Mon 30 June 2025 |

5.18 (-0.77%) |

5.23 |

5.04 - 5.47 |

0.5197 times |

Fri 30 May 2025 |

5.22 (4.61%) |

4.99 |

4.99 - 5.45 |

0.617 times |

Wed 30 April 2025 |

4.99 (-5.31%) |

5.40 |

4.54 - 5.41 |

0.8534 times |

Mon 31 March 2025 |

5.27 (9.79%) |

5.09 |

4.87 - 5.48 |

0.8691 times |

Fri 28 February 2025 |

4.80 (4.35%) |

4.55 |

4.54 - 5.06 |

0.6807 times |

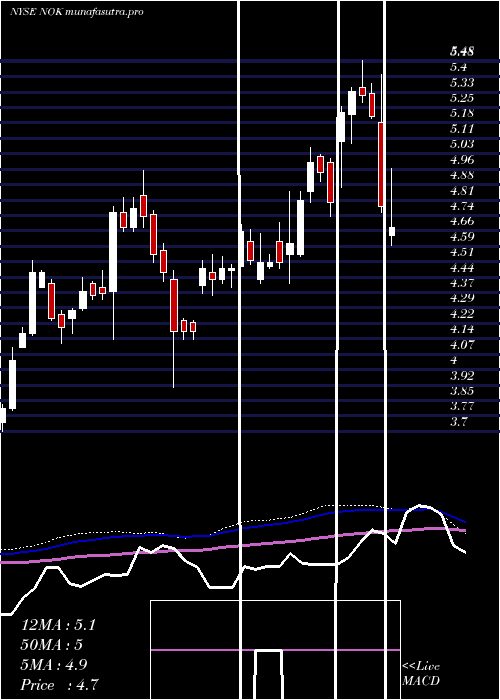

DMA SMA EMA moving averages of Nokia Corporation NOK

DMA (daily moving average) of Nokia Corporation NOK

| DMA period | DMA value | | 5 day DMA | 6.16 | | 12 day DMA | 6.13 | | 20 day DMA | 6.42 | | 35 day DMA | 6.43 | | 50 day DMA | 5.99 | | 100 day DMA | 5.2 | | 150 day DMA | 5.2 | | 200 day DMA | 5.17 | EMA (exponential moving average) of Nokia Corporation NOK

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 6.17 | 6.17 | 6.13 | | 12 day EMA | 6.22 | 6.23 | 6.23 | | 20 day EMA | 6.27 | 6.28 | 6.28 | | 35 day EMA | 6.07 | 6.06 | 6.05 | | 50 day EMA | 5.9 | 5.89 | 5.87 |

SMA (simple moving average) of Nokia Corporation NOK

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 6.16 | 6.15 | 6.11 | | 12 day SMA | 6.13 | 6.17 | 6.21 | | 20 day SMA | 6.42 | 6.45 | 6.48 | | 35 day SMA | 6.43 | 6.42 | 6.4 | | 50 day SMA | 5.99 | 5.96 | 5.93 | | 100 day SMA | 5.2 | 5.18 | 5.17 | | 150 day SMA | 5.2 | 5.19 | 5.18 | | 200 day SMA | 5.17 | 5.16 | 5.15 |

|

|