NaborsIndustries NBR full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSINabors Industries NBR WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NYSE stock exchange

operates under Energy sector & deals in Oil Gas Production

Daily price and charts and targets NaborsIndustries Strong Daily Stock price targets for NaborsIndustries NBR are 55.41 and 58.64 | Daily Target 1 | 52.76 | | Daily Target 2 | 54.83 | | Daily Target 3 | 55.986666666667 | | Daily Target 4 | 58.06 | | Daily Target 5 | 59.22 |

Daily price and volume Nabors Industries

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

56.91 (3.6%) |

55.07 |

53.91 - 57.14 |

0.9115 times |

Wed 03 December 2025 |

54.93 (9.68%) |

50.39 |

50.21 - 55.44 |

1.8531 times |

Tue 02 December 2025 |

50.08 (-2.64%) |

51.26 |

49.99 - 51.46 |

1.226 times |

Mon 01 December 2025 |

51.44 (3.15%) |

50.07 |

49.85 - 51.46 |

0.8105 times |

Fri 28 November 2025 |

49.87 (0.04%) |

50.00 |

49.25 - 50.63 |

0.326 times |

Wed 26 November 2025 |

49.85 (-0.89%) |

49.50 |

49.09 - 50.64 |

0.5562 times |

Tue 25 November 2025 |

50.30 (8.06%) |

46.34 |

45.50 - 50.47 |

1.0866 times |

Mon 24 November 2025 |

46.55 (0.78%) |

45.71 |

45.10 - 47.13 |

1.0859 times |

Fri 21 November 2025 |

46.19 (-0.11%) |

45.92 |

44.93 - 46.79 |

1.4063 times |

Thu 20 November 2025 |

46.24 (-0.64%) |

47.17 |

45.55 - 48.51 |

0.7379 times |

Wed 19 November 2025 |

46.54 (-0.75%) |

45.57 |

44.04 - 47.09 |

1.5581 times |

Weekly price and charts NaborsIndustries Strong weekly Stock price targets for NaborsIndustries NBR are 53.38 and 60.67 | Weekly Target 1 | 47.34 | | Weekly Target 2 | 52.13 | | Weekly Target 3 | 54.633333333333 | | Weekly Target 4 | 59.42 | | Weekly Target 5 | 61.92 |

Weekly price and volumes for Nabors Industries

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

56.91 (14.12%) |

50.07 |

49.85 - 57.14 |

1.3965 times |

Fri 28 November 2025 |

49.87 (7.97%) |

45.71 |

45.10 - 50.64 |

0.8886 times |

Fri 21 November 2025 |

46.19 (-6.44%) |

49.50 |

44.04 - 50.28 |

1.5473 times |

Fri 14 November 2025 |

49.37 (-4.23%) |

52.90 |

47.24 - 54.11 |

1.0134 times |

Fri 07 November 2025 |

51.55 (6.24%) |

52.38 |

49.64 - 53.60 |

0.8739 times |

Fri 31 October 2025 |

48.52 (0%) |

49.62 |

47.63 - 49.62 |

0.2058 times |

Fri 31 October 2025 |

48.52 (2.49%) |

48.50 |

45.91 - 53.82 |

1.5533 times |

Fri 24 October 2025 |

47.34 (18.71%) |

40.19 |

39.84 - 48.43 |

1.1657 times |

Fri 17 October 2025 |

39.88 (-8.93%) |

37.98 |

37.21 - 41.40 |

0.9869 times |

Tue 07 October 2025 |

43.79 (1.72%) |

44.00 |

43.00 - 46.30 |

0.3686 times |

Fri 03 October 2025 |

43.05 (3.31%) |

41.42 |

39.11 - 44.44 |

1.081 times |

Monthly price and charts NaborsIndustries Strong monthly Stock price targets for NaborsIndustries NBR are 53.38 and 60.67 | Monthly Target 1 | 47.34 | | Monthly Target 2 | 52.13 | | Monthly Target 3 | 54.633333333333 | | Monthly Target 4 | 59.42 | | Monthly Target 5 | 61.92 |

Monthly price and volumes Nabors Industries

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

56.91 (14.12%) |

50.07 |

49.85 - 57.14 |

0.2374 times |

Fri 28 November 2025 |

49.87 (2.78%) |

52.38 |

44.04 - 54.11 |

0.7349 times |

Fri 31 October 2025 |

48.52 (18.72%) |

40.31 |

37.21 - 53.82 |

0.8136 times |

Tue 30 September 2025 |

40.87 (9.63%) |

36.52 |

34.70 - 44.01 |

1.1542 times |

Fri 29 August 2025 |

37.28 (7.19%) |

33.86 |

31.10 - 37.45 |

1.2948 times |

Thu 31 July 2025 |

34.78 (24.13%) |

28.22 |

27.33 - 35.66 |

1.2636 times |

Mon 30 June 2025 |

28.02 (8.56%) |

26.80 |

26.03 - 37.50 |

1.229 times |

Fri 30 May 2025 |

25.81 (-3.84%) |

27.40 |

23.27 - 32.84 |

1.0865 times |

Wed 30 April 2025 |

26.84 (-35.65%) |

41.66 |

25.11 - 43.39 |

1.0131 times |

Mon 31 March 2025 |

41.71 (3.78%) |

40.56 |

34.42 - 45.69 |

1.1729 times |

Fri 28 February 2025 |

40.19 (-29.76%) |

56.81 |

38.37 - 60.47 |

0.805 times |

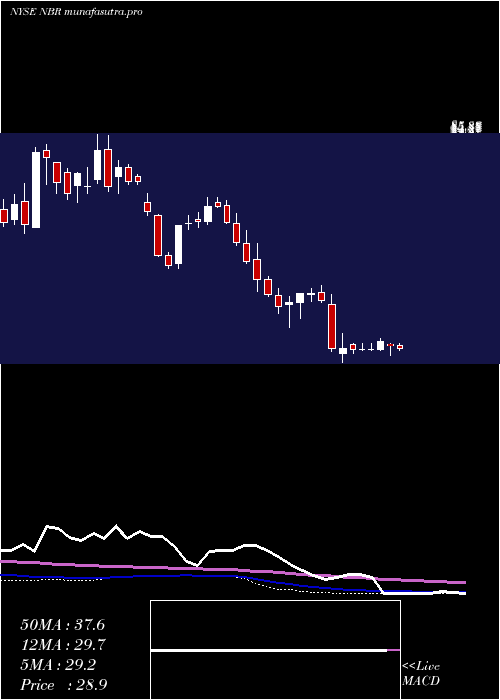

DMA SMA EMA moving averages of Nabors Industries NBR

DMA (daily moving average) of Nabors Industries NBR

| DMA period | DMA value | | 5 day DMA | 52.65 | | 12 day DMA | 49.65 | | 20 day DMA | 49.83 | | 35 day DMA | 48.3 | | 50 day DMA | 46.21 | | 100 day DMA | 40.83 | | 150 day DMA | 37.09 | | 200 day DMA | 37.23 | EMA (exponential moving average) of Nabors Industries NBR

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 53.36 | 51.58 | 49.91 | | 12 day EMA | 51.11 | 50.06 | 49.17 | | 20 day EMA | 49.96 | 49.23 | 48.63 | | 35 day EMA | 47.97 | 47.44 | 47 | | 50 day EMA | 46.38 | 45.95 | 45.58 |

SMA (simple moving average) of Nabors Industries NBR

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 52.65 | 51.23 | 50.31 | | 12 day SMA | 49.65 | 48.86 | 48.39 | | 20 day SMA | 49.83 | 49.58 | 49.42 | | 35 day SMA | 48.3 | 47.81 | 47.38 | | 50 day SMA | 46.21 | 45.83 | 45.51 | | 100 day SMA | 40.83 | 40.61 | 40.4 | | 150 day SMA | 37.09 | 36.91 | 36.74 | | 200 day SMA | 37.23 | 37.21 | 37.22 |

|

|