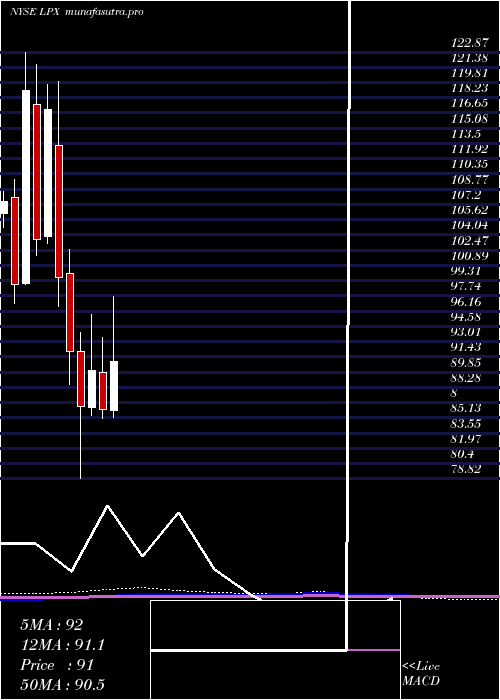

LouisianaPacific LPX full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSILouisiana Pacific LPX WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NYSE stock exchange

operates under Basic Industries sector & deals in Forest Products

Daily price and charts and targets LouisianaPacific Strong Daily Stock price targets for LouisianaPacific LPX are 89.51 and 91.27 | Daily Target 1 | 88.12 | | Daily Target 2 | 89.13 | | Daily Target 3 | 89.88 | | Daily Target 4 | 90.89 | | Daily Target 5 | 91.64 |

Daily price and volume Louisiana Pacific

| Date |

Closing |

Open |

Range |

Volume |

Fri 17 October 2025 |

90.14 (-0.13%) |

89.76 |

88.87 - 90.63 |

0.4067 times |

Thu 16 October 2025 |

90.26 (-2.97%) |

93.51 |

89.41 - 93.74 |

0.8455 times |

Wed 15 October 2025 |

93.02 (0.25%) |

93.17 |

91.92 - 93.60 |

1.0212 times |

Tue 14 October 2025 |

92.79 (3.41%) |

89.08 |

89.08 - 93.85 |

1.0733 times |

Mon 13 October 2025 |

89.73 (-0.19%) |

88.77 |

88.58 - 90.34 |

1.2641 times |

Tue 07 October 2025 |

89.90 (0.8%) |

91.07 |

89.03 - 92.55 |

1.5093 times |

Mon 06 October 2025 |

89.19 (-1.35%) |

90.02 |

87.95 - 90.88 |

0.5284 times |

Fri 03 October 2025 |

90.41 (0.48%) |

90.27 |

89.35 - 90.90 |

1.3778 times |

Thu 02 October 2025 |

89.98 (-0.22%) |

89.72 |

89.44 - 90.84 |

0.6465 times |

Wed 01 October 2025 |

90.18 (1.51%) |

88.94 |

88.44 - 90.30 |

1.3272 times |

Tue 30 September 2025 |

88.84 (4.27%) |

85.26 |

84.68 - 89.02 |

1.6007 times |

Weekly price and charts LouisianaPacific Strong weekly Stock price targets for LouisianaPacific LPX are 89.36 and 94.63 | Weekly Target 1 | 85.59 | | Weekly Target 2 | 87.86 | | Weekly Target 3 | 90.856666666667 | | Weekly Target 4 | 93.13 | | Weekly Target 5 | 96.13 |

Weekly price and volumes for Louisiana Pacific

| Date |

Closing |

Open |

Range |

Volume |

Fri 17 October 2025 |

90.14 (0.27%) |

88.77 |

88.58 - 93.85 |

1.0138 times |

Tue 07 October 2025 |

89.90 (-0.56%) |

90.02 |

87.95 - 92.55 |

0.448 times |

Fri 03 October 2025 |

90.41 (6.72%) |

85.12 |

83.38 - 90.90 |

1.3552 times |

Fri 26 September 2025 |

84.72 (-4.05%) |

88.31 |

82.30 - 88.31 |

1.2336 times |

Fri 19 September 2025 |

88.30 (-7.93%) |

96.52 |

87.76 - 96.52 |

1.3441 times |

Fri 12 September 2025 |

95.91 (-3.14%) |

98.28 |

94.78 - 99.37 |

0.7087 times |

Fri 05 September 2025 |

99.02 (4.11%) |

93.56 |

91.63 - 101.28 |

0.9151 times |

Fri 29 August 2025 |

95.11 (0%) |

96.05 |

94.59 - 96.14 |

0.2078 times |

Fri 29 August 2025 |

95.11 (-4.39%) |

98.68 |

94.59 - 99.44 |

1.376 times |

Fri 22 August 2025 |

99.48 (-0.03%) |

99.57 |

90.64 - 99.78 |

1.3977 times |

Fri 15 August 2025 |

99.51 (9.58%) |

90.74 |

89.65 - 102.86 |

1.4891 times |

Monthly price and charts LouisianaPacific Strong monthly Stock price targets for LouisianaPacific LPX are 89.05 and 94.95 | Monthly Target 1 | 84.75 | | Monthly Target 2 | 87.44 | | Monthly Target 3 | 90.646666666667 | | Monthly Target 4 | 93.34 | | Monthly Target 5 | 96.55 |

Monthly price and volumes Louisiana Pacific

| Date |

Closing |

Open |

Range |

Volume |

Fri 17 October 2025 |

90.14 (1.46%) |

88.94 |

87.95 - 93.85 |

0.5087 times |

Tue 30 September 2025 |

88.84 (-6.59%) |

93.56 |

82.30 - 101.28 |

1.115 times |

Fri 29 August 2025 |

95.11 (5.2%) |

90.00 |

87.69 - 102.86 |

1.4433 times |

Thu 31 July 2025 |

90.41 (5.14%) |

85.83 |

85.21 - 97.62 |

0.9077 times |

Mon 30 June 2025 |

85.99 (-4.53%) |

89.80 |

85.03 - 93.44 |

1.296 times |

Fri 30 May 2025 |

90.07 (4.36%) |

86.19 |

85.35 - 95.77 |

1.1916 times |

Wed 30 April 2025 |

86.31 (-6.16%) |

92.00 |

78.82 - 93.94 |

0.8273 times |

Mon 31 March 2025 |

91.98 (-7.72%) |

100.03 |

88.60 - 102.49 |

0.7895 times |

Fri 28 February 2025 |

99.67 (-14.79%) |

113.29 |

96.68 - 119.91 |

1.0053 times |

Fri 31 January 2025 |

116.97 (12.96%) |

103.91 |

103.19 - 119.58 |

0.9157 times |

Tue 31 December 2024 |

103.55 (-12.95%) |

117.57 |

101.95 - 121.61 |

0.6917 times |

DMA SMA EMA moving averages of Louisiana Pacific LPX

DMA (daily moving average) of Louisiana Pacific LPX

| DMA period | DMA value | | 5 day DMA | 91.19 | | 12 day DMA | 89.97 | | 20 day DMA | 88.69 | | 35 day DMA | 91.74 | | 50 day DMA | 93.05 | | 100 day DMA | 91.49 | | 150 day DMA | 90.68 | | 200 day DMA | 94.95 | EMA (exponential moving average) of Louisiana Pacific LPX

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 90.73 | 91.03 | 91.41 | | 12 day EMA | 90.24 | 90.26 | 90.26 | | 20 day EMA | 90.37 | 90.39 | 90.4 | | 35 day EMA | 91.13 | 91.19 | 91.24 | | 50 day EMA | 92.71 | 92.82 | 92.92 |

SMA (simple moving average) of Louisiana Pacific LPX

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 91.19 | 91.14 | 90.93 | | 12 day SMA | 89.97 | 89.52 | 88.95 | | 20 day SMA | 88.69 | 88.87 | 89.11 | | 35 day SMA | 91.74 | 91.94 | 92.19 | | 50 day SMA | 93.05 | 93.14 | 93.15 | | 100 day SMA | 91.49 | 91.51 | 91.56 | | 150 day SMA | 90.68 | 90.67 | 90.67 | | 200 day SMA | 94.95 | 95.02 | 95.09 |

|

|