CarvanaCo CVNA full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSICarvana Co CVNA WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NYSE stock exchange

operates under Consumer Durables sector & deals in Automotive Aftermarket

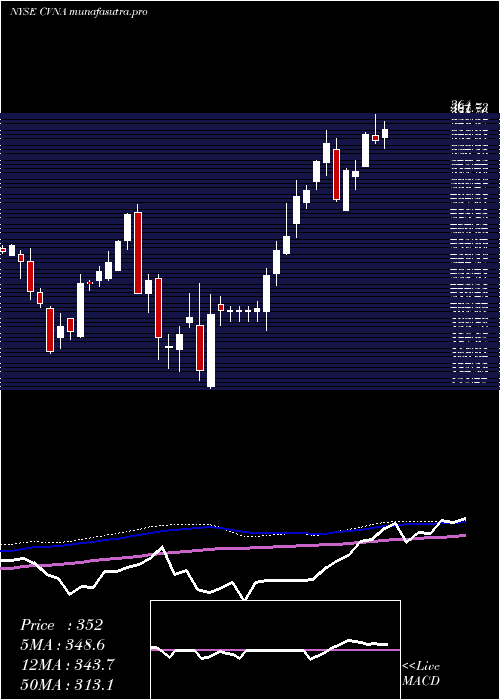

Daily price and charts and targets CarvanaCo Strong Daily Stock price targets for CarvanaCo CVNA are 392.66 and 405.91 | Daily Target 1 | 381.78 | | Daily Target 2 | 390.29 | | Daily Target 3 | 395.02666666667 | | Daily Target 4 | 403.54 | | Daily Target 5 | 408.28 |

Daily price and volume Carvana Co

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

398.81 (0.96%) |

396.47 |

386.51 - 399.76 |

0.5461 times |

Wed 03 December 2025 |

395.00 (3.34%) |

381.22 |

380.00 - 401.55 |

1.1988 times |

Tue 02 December 2025 |

382.23 (1.86%) |

378.16 |

373.00 - 392.87 |

0.6909 times |

Mon 01 December 2025 |

375.26 (0.2%) |

371.52 |

369.57 - 382.50 |

1.1805 times |

Fri 28 November 2025 |

374.50 (4.74%) |

362.08 |

357.50 - 375.77 |

0.8031 times |

Wed 26 November 2025 |

357.56 (1.74%) |

350.95 |

348.39 - 364.20 |

0.9979 times |

Tue 25 November 2025 |

351.44 (6.21%) |

331.13 |

326.60 - 351.45 |

0.7343 times |

Mon 24 November 2025 |

330.90 (6.78%) |

320.63 |

319.99 - 335.89 |

1.5039 times |

Fri 21 November 2025 |

309.88 (-1.08%) |

318.54 |

308.50 - 327.00 |

1.1952 times |

Thu 20 November 2025 |

313.25 (-5%) |

335.80 |

309.30 - 340.79 |

1.1493 times |

Wed 19 November 2025 |

329.75 (3.95%) |

321.75 |

319.48 - 332.28 |

0.9154 times |

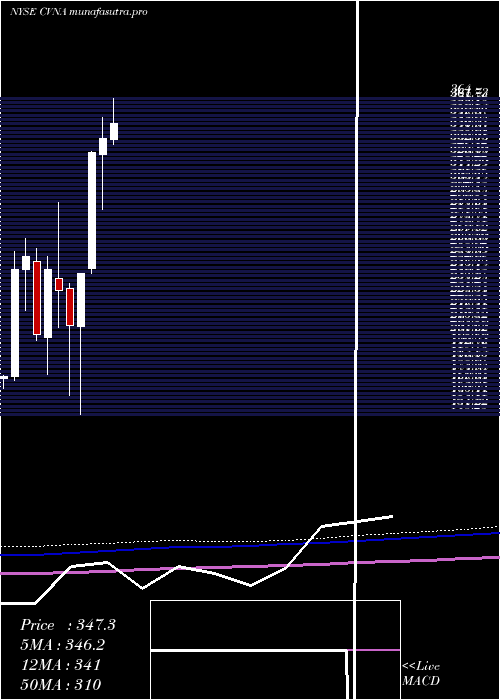

Weekly price and charts CarvanaCo Strong weekly Stock price targets for CarvanaCo CVNA are 384.19 and 416.17 | Weekly Target 1 | 358 | | Weekly Target 2 | 378.4 | | Weekly Target 3 | 389.97666666667 | | Weekly Target 4 | 410.38 | | Weekly Target 5 | 421.96 |

Weekly price and volumes for Carvana Co

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

398.81 (6.49%) |

371.52 |

369.57 - 401.55 |

0.8042 times |

Fri 28 November 2025 |

374.50 (20.85%) |

320.63 |

319.99 - 375.77 |

0.8983 times |

Fri 21 November 2025 |

309.88 (-2.65%) |

316.00 |

308.50 - 340.79 |

1.144 times |

Fri 14 November 2025 |

318.31 (4.66%) |

307.46 |

305.00 - 345.24 |

0.8068 times |

Fri 07 November 2025 |

304.14 (-0.78%) |

325.13 |

283.00 - 328.00 |

0.9486 times |

Fri 31 October 2025 |

306.54 (0%) |

308.28 |

298.08 - 309.66 |

0.4462 times |

Fri 31 October 2025 |

306.54 (-12.72%) |

356.30 |

298.08 - 372.31 |

2.1811 times |

Fri 24 October 2025 |

351.20 (5.15%) |

335.18 |

310.01 - 357.68 |

0.9691 times |

Fri 17 October 2025 |

334.00 (1.45%) |

333.52 |

323.45 - 364.37 |

0.8304 times |

Fri 10 October 2025 |

329.24 (-12.52%) |

378.89 |

327.52 - 381.63 |

0.9712 times |

Fri 03 October 2025 |

376.38 (1.92%) |

373.00 |

370.50 - 401.00 |

0.9639 times |

Monthly price and charts CarvanaCo Strong monthly Stock price targets for CarvanaCo CVNA are 384.19 and 416.17 | Monthly Target 1 | 358 | | Monthly Target 2 | 378.4 | | Monthly Target 3 | 389.97666666667 | | Monthly Target 4 | 410.38 | | Monthly Target 5 | 421.96 |

Monthly price and volumes Carvana Co

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

398.81 (6.49%) |

371.52 |

369.57 - 401.55 |

0.1532 times |

Fri 28 November 2025 |

374.50 (22.17%) |

325.13 |

283.00 - 375.77 |

0.7234 times |

Fri 31 October 2025 |

306.54 (-18.74%) |

388.32 |

298.08 - 401.00 |

1.1088 times |

Tue 30 September 2025 |

377.24 (1.43%) |

362.04 |

349.07 - 396.96 |

0.814 times |

Fri 29 August 2025 |

371.92 (-4.68%) |

380.99 |

318.17 - 384.26 |

0.8343 times |

Thu 31 July 2025 |

390.17 (15.79%) |

335.90 |

325.86 - 413.34 |

0.9834 times |

Mon 30 June 2025 |

336.96 (3%) |

326.24 |

288.50 - 351.43 |

1.0805 times |

Fri 30 May 2025 |

327.16 (33.89%) |

248.00 |

245.00 - 327.75 |

1.335 times |

Wed 30 April 2025 |

244.35 (16.87%) |

208.30 |

148.25 - 244.76 |

1.4436 times |

Mon 31 March 2025 |

209.08 (-10.3%) |

234.50 |

161.64 - 237.87 |

1.5238 times |

Fri 28 February 2025 |

233.10 (-5.81%) |

240.97 |

207.85 - 292.84 |

1.0978 times |

DMA SMA EMA moving averages of Carvana Co CVNA

DMA (daily moving average) of Carvana Co CVNA

| DMA period | DMA value | | 5 day DMA | 385.16 | | 12 day DMA | 352.98 | | 20 day DMA | 338.36 | | 35 day DMA | 336.22 | | 50 day DMA | 345.48 | | 100 day DMA | 351.92 | | 150 day DMA | 339.62 | | 200 day DMA | 306.09 | EMA (exponential moving average) of Carvana Co CVNA

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 383.84 | 376.36 | 367.04 | | 12 day EMA | 362.69 | 356.13 | 349.07 | | 20 day EMA | 352.1 | 347.18 | 342.15 | | 35 day EMA | 349.88 | 347 | 344.17 | | 50 day EMA | 352.58 | 350.69 | 348.88 |

SMA (simple moving average) of Carvana Co CVNA

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 385.16 | 376.91 | 368.2 | | 12 day SMA | 352.98 | 346.68 | 340.29 | | 20 day SMA | 338.36 | 333.91 | 329.64 | | 35 day SMA | 336.22 | 334.98 | 333.58 | | 50 day SMA | 345.48 | 345 | 344.66 | | 100 day SMA | 351.92 | 351.42 | 350.94 | | 150 day SMA | 339.62 | 338.59 | 337.58 | | 200 day SMA | 306.09 | 305.51 | 304.95 |

|

|