BorrDrilling BORR full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSIBorr Drilling BORR WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NYSE stock exchange

Daily price and charts and targets BorrDrilling Strong Daily Stock price targets for BorrDrilling BORR are 3.72 and 3.83 | Daily Target 1 | 3.63 | | Daily Target 2 | 3.7 | | Daily Target 3 | 3.7433333333333 | | Daily Target 4 | 3.81 | | Daily Target 5 | 3.85 |

Daily price and volume Borr Drilling

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

3.76 (-0.79%) |

3.75 |

3.68 - 3.79 |

1.0298 times |

Wed 03 December 2025 |

3.79 (7.37%) |

3.55 |

3.55 - 3.79 |

1.5427 times |

Tue 02 December 2025 |

3.53 (2.32%) |

3.47 |

3.33 - 3.65 |

1.3761 times |

Mon 01 December 2025 |

3.45 (4.23%) |

3.27 |

3.27 - 3.53 |

1.3302 times |

Fri 28 November 2025 |

3.31 (1.22%) |

3.27 |

3.25 - 3.34 |

0.5304 times |

Wed 26 November 2025 |

3.27 (-1.8%) |

3.30 |

3.26 - 3.31 |

0.7176 times |

Tue 25 November 2025 |

3.33 (5.38%) |

3.18 |

3.12 - 3.34 |

0.9841 times |

Mon 24 November 2025 |

3.16 (2.27%) |

3.14 |

3.07 - 3.19 |

0.5929 times |

Fri 21 November 2025 |

3.09 (3.34%) |

2.98 |

2.89 - 3.10 |

0.9317 times |

Thu 20 November 2025 |

2.99 (-3.55%) |

3.19 |

2.97 - 3.25 |

0.9645 times |

Wed 19 November 2025 |

3.10 (-0.96%) |

3.13 |

3.05 - 3.16 |

0.5457 times |

Weekly price and charts BorrDrilling Strong weekly Stock price targets for BorrDrilling BORR are 3.52 and 4.04 | Weekly Target 1 | 3.09 | | Weekly Target 2 | 3.42 | | Weekly Target 3 | 3.6066666666667 | | Weekly Target 4 | 3.94 | | Weekly Target 5 | 4.13 |

Weekly price and volumes for Borr Drilling

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

3.76 (13.6%) |

3.27 |

3.27 - 3.79 |

1.1733 times |

Fri 28 November 2025 |

3.31 (7.12%) |

3.14 |

3.07 - 3.34 |

0.6279 times |

Fri 21 November 2025 |

3.09 (-4.63%) |

3.24 |

2.89 - 3.29 |

0.9025 times |

Fri 14 November 2025 |

3.24 (1.89%) |

3.23 |

3.11 - 3.61 |

1.3693 times |

Fri 07 November 2025 |

3.18 (2.58%) |

3.03 |

2.98 - 3.33 |

1.0424 times |

Fri 31 October 2025 |

3.10 (0%) |

3.11 |

3.00 - 3.15 |

0.2341 times |

Fri 31 October 2025 |

3.10 (2.65%) |

3.13 |

2.91 - 3.32 |

1.464 times |

Fri 24 October 2025 |

3.02 (17.05%) |

2.65 |

2.60 - 3.14 |

1.3246 times |

Fri 17 October 2025 |

2.58 (5.74%) |

2.51 |

2.47 - 2.75 |

0.7637 times |

Fri 10 October 2025 |

2.44 (-14.08%) |

2.91 |

2.44 - 2.91 |

1.0981 times |

Fri 03 October 2025 |

2.84 (-3.07%) |

2.90 |

2.60 - 2.91 |

0.9355 times |

Monthly price and charts BorrDrilling Strong monthly Stock price targets for BorrDrilling BORR are 3.52 and 4.04 | Monthly Target 1 | 3.09 | | Monthly Target 2 | 3.42 | | Monthly Target 3 | 3.6066666666667 | | Monthly Target 4 | 3.94 | | Monthly Target 5 | 4.13 |

Monthly price and volumes Borr Drilling

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

3.76 (13.6%) |

3.27 |

3.27 - 3.79 |

0.241 times |

Fri 28 November 2025 |

3.31 (6.77%) |

3.03 |

2.89 - 3.61 |

0.8096 times |

Fri 31 October 2025 |

3.10 (15.24%) |

2.65 |

2.44 - 3.32 |

1.1056 times |

Tue 30 September 2025 |

2.69 (-7.56%) |

2.91 |

2.60 - 3.26 |

0.9048 times |

Fri 29 August 2025 |

2.91 (43.35%) |

1.99 |

1.86 - 3.01 |

1.291 times |

Thu 31 July 2025 |

2.03 (10.93%) |

1.85 |

1.82 - 2.31 |

0.9651 times |

Mon 30 June 2025 |

1.83 (4.57%) |

1.82 |

1.66 - 2.35 |

1.1867 times |

Fri 30 May 2025 |

1.75 (2.94%) |

1.70 |

1.55 - 2.02 |

1.1947 times |

Wed 30 April 2025 |

1.70 (-22.37%) |

2.19 |

1.62 - 2.33 |

1.2489 times |

Mon 31 March 2025 |

2.19 (-13.78%) |

2.55 |

2.08 - 2.58 |

1.0526 times |

Fri 28 February 2025 |

2.54 (-26.8%) |

3.43 |

2.51 - 3.60 |

1.1893 times |

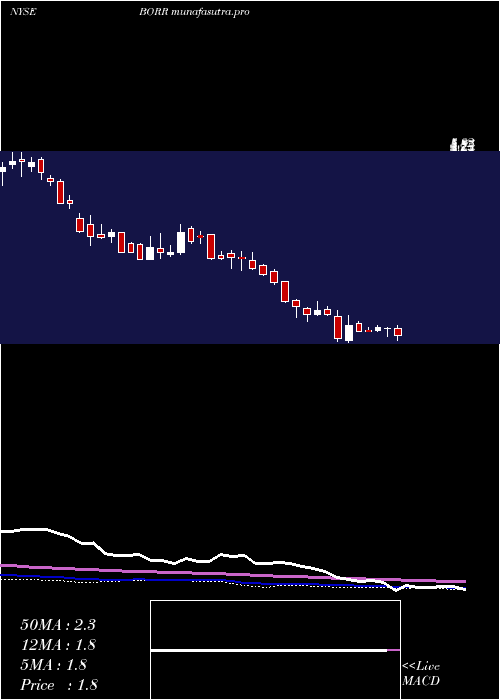

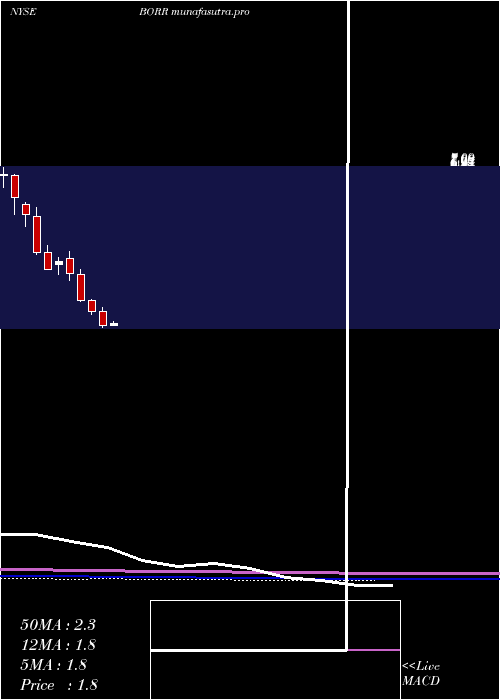

DMA SMA EMA moving averages of Borr Drilling BORR

DMA (daily moving average) of Borr Drilling BORR

| DMA period | DMA value | | 5 day DMA | 3.57 | | 12 day DMA | 3.33 | | 20 day DMA | 3.3 | | 35 day DMA | 3.14 | | 50 day DMA | 3.02 | | 100 day DMA | 2.79 | | 150 day DMA | 2.5 | | 200 day DMA | 2.43 | EMA (exponential moving average) of Borr Drilling BORR

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 3.6 | 3.52 | 3.39 | | 12 day EMA | 3.42 | 3.36 | 3.28 | | 20 day EMA | 3.32 | 3.27 | 3.22 | | 35 day EMA | 3.19 | 3.16 | 3.12 | | 50 day EMA | 3.08 | 3.05 | 3.02 |

SMA (simple moving average) of Borr Drilling BORR

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 3.57 | 3.47 | 3.38 | | 12 day SMA | 3.33 | 3.28 | 3.23 | | 20 day SMA | 3.3 | 3.26 | 3.22 | | 35 day SMA | 3.14 | 3.11 | 3.08 | | 50 day SMA | 3.02 | 3.01 | 2.99 | | 100 day SMA | 2.79 | 2.78 | 2.76 | | 150 day SMA | 2.5 | 2.48 | 2.47 | | 200 day SMA | 2.43 | 2.43 | 2.43 |

|

|