VirBiotechnology VIR full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSIVir Biotechnology VIR WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NASDAQ stock exchange

Daily price and charts and targets VirBiotechnology Strong Daily Stock price targets for VirBiotechnology VIR are 4.94 and 5.17 | Daily Target 1 | 4.9 | | Daily Target 2 | 4.98 | | Daily Target 3 | 5.1266666666667 | | Daily Target 4 | 5.21 | | Daily Target 5 | 5.36 |

Daily price and volume Vir Biotechnology

| Date |

Closing |

Open |

Range |

Volume |

Thu 31 July 2025 |

5.07 (-3.24%) |

5.23 |

5.04 - 5.27 |

0.9988 times |

Wed 30 July 2025 |

5.24 (-0.19%) |

5.34 |

5.21 - 5.46 |

0.9662 times |

Tue 29 July 2025 |

5.25 (-4.2%) |

5.49 |

5.22 - 5.49 |

0.7294 times |

Mon 28 July 2025 |

5.48 (-3.01%) |

5.68 |

5.46 - 5.76 |

0.6057 times |

Fri 25 July 2025 |

5.65 (-1.91%) |

5.75 |

5.63 - 5.76 |

0.9014 times |

Thu 24 July 2025 |

5.76 (-1.54%) |

5.79 |

5.70 - 5.89 |

0.7638 times |

Wed 23 July 2025 |

5.85 (2.09%) |

5.84 |

5.66 - 5.91 |

0.6383 times |

Tue 22 July 2025 |

5.73 (3.8%) |

5.55 |

5.55 - 5.74 |

0.9666 times |

Mon 21 July 2025 |

5.52 (2.03%) |

5.47 |

5.47 - 5.98 |

1.2145 times |

Fri 18 July 2025 |

5.41 (-0.73%) |

5.56 |

5.30 - 5.61 |

2.2153 times |

Thu 17 July 2025 |

5.45 (0.74%) |

5.43 |

5.40 - 5.59 |

0.9443 times |

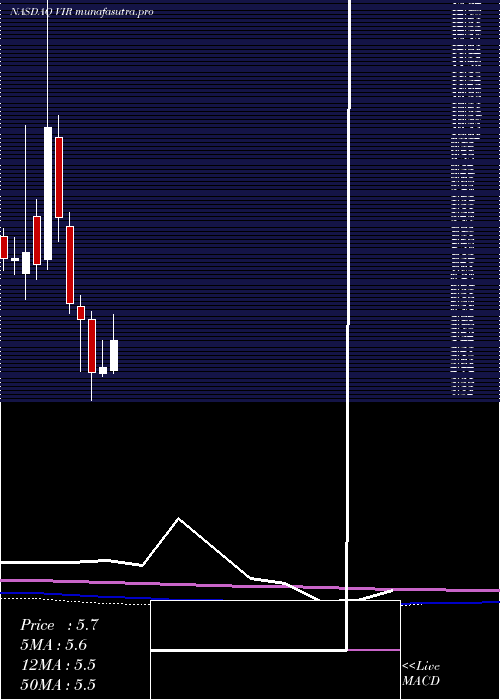

Weekly price and charts VirBiotechnology Strong weekly Stock price targets for VirBiotechnology VIR are 4.7 and 5.42 | Weekly Target 1 | 4.57 | | Weekly Target 2 | 4.82 | | Weekly Target 3 | 5.29 | | Weekly Target 4 | 5.54 | | Weekly Target 5 | 6.01 |

Weekly price and volumes for Vir Biotechnology

| Date |

Closing |

Open |

Range |

Volume |

Thu 31 July 2025 |

5.07 (-10.27%) |

5.68 |

5.04 - 5.76 |

0.5749 times |

Fri 25 July 2025 |

5.65 (4.44%) |

5.47 |

5.47 - 5.98 |

0.7813 times |

Fri 18 July 2025 |

5.41 (-4.25%) |

5.64 |

5.20 - 5.70 |

1.1966 times |

Fri 11 July 2025 |

5.65 (4.44%) |

5.38 |

5.20 - 6.23 |

1.4193 times |

Thu 03 July 2025 |

5.41 (4.64%) |

5.18 |

4.91 - 5.49 |

0.7253 times |

Fri 27 June 2025 |

5.17 (-1.15%) |

5.15 |

4.95 - 5.34 |

0.9177 times |

Fri 20 June 2025 |

5.23 (0.19%) |

5.16 |

5.02 - 5.34 |

0.9088 times |

Fri 13 June 2025 |

5.22 (-4.22%) |

5.56 |

5.01 - 5.66 |

0.9653 times |

Fri 06 June 2025 |

5.45 (10.32%) |

4.91 |

4.85 - 5.48 |

1.2014 times |

Fri 30 May 2025 |

4.94 (9.78%) |

4.57 |

4.44 - 5.24 |

1.3093 times |

Fri 23 May 2025 |

4.50 (-2.17%) |

4.50 |

4.37 - 4.85 |

1.325 times |

Monthly price and charts VirBiotechnology Strong monthly Stock price targets for VirBiotechnology VIR are 4.99 and 6.31 | Monthly Target 1 | 4.08 | | Monthly Target 2 | 4.58 | | Monthly Target 3 | 5.4033333333333 | | Monthly Target 4 | 5.9 | | Monthly Target 5 | 6.72 |

Monthly price and volumes Vir Biotechnology

| Date |

Closing |

Open |

Range |

Volume |

Thu 31 July 2025 |

5.07 (0.6%) |

4.99 |

4.91 - 6.23 |

0.7301 times |

Mon 30 June 2025 |

5.04 (2.02%) |

4.91 |

4.85 - 5.66 |

0.6722 times |

Fri 30 May 2025 |

4.94 (-19.28%) |

6.12 |

4.32 - 6.29 |

1.0058 times |

Wed 30 April 2025 |

6.12 (-5.56%) |

6.42 |

4.95 - 6.65 |

0.7112 times |

Mon 31 March 2025 |

6.48 (-22.77%) |

8.19 |

6.25 - 8.51 |

0.7425 times |

Fri 28 February 2025 |

8.39 (-19.33%) |

10.19 |

7.86 - 10.67 |

0.6796 times |

Fri 31 January 2025 |

10.40 (41.69%) |

7.45 |

7.23 - 14.45 |

3.4671 times |

Tue 31 December 2024 |

7.34 (-3.67%) |

8.41 |

7.02 - 8.80 |

0.52 times |

Tue 26 November 2024 |

7.62 (1.74%) |

7.14 |

6.56 - 10.44 |

0.9199 times |

Thu 31 October 2024 |

7.49 (0%) |

7.44 |

7.12 - 7.94 |

0.5514 times |

Mon 30 September 2024 |

7.49 (-9.32%) |

8.15 |

7.21 - 8.35 |

0.5057 times |

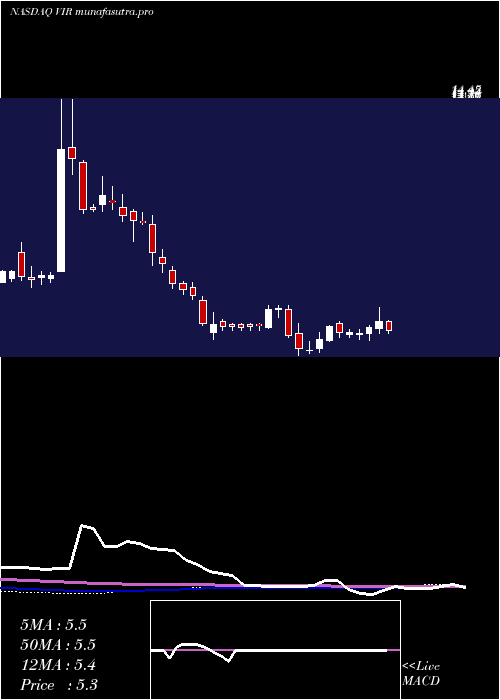

DMA SMA EMA moving averages of Vir Biotechnology VIR

DMA (daily moving average) of Vir Biotechnology VIR

| DMA period | DMA value | | 5 day DMA | 5.34 | | 12 day DMA | 5.49 | | 20 day DMA | 5.51 | | 35 day DMA | 5.38 | | 50 day DMA | 5.25 | | 100 day DMA | 5.61 | | 150 day DMA | 6.9 | | 200 day DMA | 7.15 | EMA (exponential moving average) of Vir Biotechnology VIR

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 5.3 | 5.41 | 5.49 | | 12 day EMA | 5.42 | 5.48 | 5.52 | | 20 day EMA | 5.42 | 5.46 | 5.48 | | 35 day EMA | 5.34 | 5.36 | 5.37 | | 50 day EMA | 5.21 | 5.22 | 5.22 |

SMA (simple moving average) of Vir Biotechnology VIR

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 5.34 | 5.48 | 5.6 | | 12 day SMA | 5.49 | 5.5 | 5.53 | | 20 day SMA | 5.51 | 5.52 | 5.52 | | 35 day SMA | 5.38 | 5.39 | 5.4 | | 50 day SMA | 5.25 | 5.24 | 5.23 | | 100 day SMA | 5.61 | 5.64 | 5.67 | | 150 day SMA | 6.9 | 6.92 | 6.93 | | 200 day SMA | 7.15 | 7.16 | 7.18 |

|

|