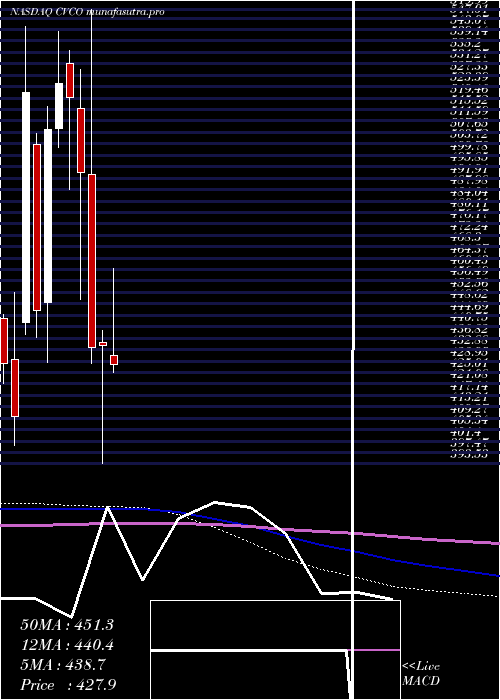

CavcoIndustries CVCO full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSICavco Industries CVCO WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NASDAQ stock exchange

operates under Basic Industries sector & deals in Homebuilding

Daily price and charts and targets CavcoIndustries Strong Daily Stock price targets for CavcoIndustries CVCO are 571.83 and 584.07 | Daily Target 1 | 569.55 | | Daily Target 2 | 574.1 | | Daily Target 3 | 581.79333333333 | | Daily Target 4 | 586.34 | | Daily Target 5 | 594.03 |

Daily price and volume Cavco Industries

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

578.64 (0.11%) |

579.94 |

577.25 - 589.49 |

1.0971 times |

Thu 04 December 2025 |

577.99 (-1.48%) |

586.59 |

573.31 - 593.00 |

1.298 times |

Wed 03 December 2025 |

586.69 (0.24%) |

580.00 |

580.00 - 608.06 |

1.4359 times |

Tue 02 December 2025 |

585.27 (0.18%) |

587.25 |

571.60 - 594.45 |

1.1848 times |

Mon 01 December 2025 |

584.22 (-1.92%) |

589.09 |

568.09 - 603.58 |

1.5509 times |

Fri 28 November 2025 |

595.65 (-2.13%) |

606.32 |

584.62 - 611.72 |

0.7092 times |

Wed 26 November 2025 |

608.60 (2.03%) |

591.59 |

590.59 - 613.77 |

0.8 times |

Tue 25 November 2025 |

596.48 (4.2%) |

573.39 |

573.39 - 604.91 |

0.4223 times |

Mon 24 November 2025 |

572.46 (-0.16%) |

569.98 |

555.45 - 576.24 |

0.754 times |

Fri 21 November 2025 |

573.39 (5.37%) |

547.28 |

541.96 - 577.10 |

0.7479 times |

Thu 20 November 2025 |

544.16 (0.26%) |

551.70 |

540.41 - 557.65 |

0.4732 times |

Weekly price and charts CavcoIndustries Strong weekly Stock price targets for CavcoIndustries CVCO are 553.38 and 593.35 | Weekly Target 1 | 544.96 | | Weekly Target 2 | 561.8 | | Weekly Target 3 | 584.93 | | Weekly Target 4 | 601.77 | | Weekly Target 5 | 624.9 |

Weekly price and volumes for Cavco Industries

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

578.64 (-2.86%) |

589.09 |

568.09 - 608.06 |

1.6769 times |

Fri 28 November 2025 |

595.65 (3.88%) |

569.98 |

555.45 - 613.77 |

0.6857 times |

Fri 21 November 2025 |

573.39 (2.76%) |

558.34 |

536.04 - 577.10 |

0.7377 times |

Fri 14 November 2025 |

557.97 (-3.2%) |

577.87 |

539.56 - 586.34 |

0.5693 times |

Fri 07 November 2025 |

576.43 (8.8%) |

531.63 |

521.00 - 586.89 |

0.9072 times |

Fri 31 October 2025 |

529.80 (0%) |

556.10 |

510.69 - 579.36 |

0.4305 times |

Fri 31 October 2025 |

529.80 (-10.34%) |

591.46 |

491.29 - 599.08 |

1.4496 times |

Fri 24 October 2025 |

590.92 (6.56%) |

555.71 |

552.31 - 602.57 |

0.9404 times |

Fri 17 October 2025 |

554.52 (11.4%) |

502.43 |

486.47 - 557.08 |

1.228 times |

Fri 10 October 2025 |

497.78 (-12.74%) |

572.50 |

490.90 - 572.50 |

1.3747 times |

Fri 03 October 2025 |

570.43 (-0.36%) |

575.78 |

568.98 - 600.00 |

1.3903 times |

Monthly price and charts CavcoIndustries Strong monthly Stock price targets for CavcoIndustries CVCO are 553.38 and 593.35 | Monthly Target 1 | 544.96 | | Monthly Target 2 | 561.8 | | Monthly Target 3 | 584.93 | | Monthly Target 4 | 601.77 | | Monthly Target 5 | 624.9 |

Monthly price and volumes Cavco Industries

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

578.64 (-2.86%) |

589.09 |

568.09 - 608.06 |

0.4208 times |

Fri 28 November 2025 |

595.65 (12.43%) |

531.63 |

521.00 - 613.77 |

0.7278 times |

Fri 31 October 2025 |

529.80 (-8.77%) |

577.63 |

486.47 - 602.57 |

1.5531 times |

Tue 30 September 2025 |

580.73 (9.47%) |

524.11 |

522.32 - 600.00 |

1.585 times |

Fri 29 August 2025 |

530.49 (31.42%) |

429.70 |

406.98 - 536.57 |

1.1171 times |

Thu 31 July 2025 |

403.67 (-7.08%) |

430.94 |

397.38 - 460.62 |

1.1916 times |

Mon 30 June 2025 |

434.43 (0.19%) |

435.25 |

393.53 - 439.48 |

1.6515 times |

Fri 30 May 2025 |

433.60 (-12.2%) |

493.10 |

427.97 - 549.99 |

0.7506 times |

Wed 30 April 2025 |

493.85 (-4.96%) |

515.86 |

450.20 - 529.45 |

0.4985 times |

Mon 31 March 2025 |

519.63 (-0.93%) |

531.33 |

487.94 - 535.75 |

0.504 times |

Fri 28 February 2025 |

524.53 (3.12%) |

509.11 |

502.56 - 542.47 |

0.4295 times |

DMA SMA EMA moving averages of Cavco Industries CVCO

DMA (daily moving average) of Cavco Industries CVCO

| DMA period | DMA value | | 5 day DMA | 582.56 | | 12 day DMA | 578.86 | | 20 day DMA | 571.4 | | 35 day DMA | 564.77 | | 50 day DMA | 557.13 | | 100 day DMA | 525.82 | | 150 day DMA | 503.31 | | 200 day DMA | 502.46 | EMA (exponential moving average) of Cavco Industries CVCO

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 582 | 583.68 | 586.52 | | 12 day EMA | 578.49 | 578.46 | 578.55 | | 20 day EMA | 573.2 | 572.63 | 572.07 | | 35 day EMA | 566.63 | 565.92 | 565.21 | | 50 day EMA | 560.02 | 559.26 | 558.5 |

SMA (simple moving average) of Cavco Industries CVCO

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 582.56 | 585.96 | 592.09 | | 12 day SMA | 578.86 | 575.57 | 572.93 | | 20 day SMA | 571.4 | 571.16 | 570.26 | | 35 day SMA | 564.77 | 563.68 | 562.3 | | 50 day SMA | 557.13 | 556.7 | 556.4 | | 100 day SMA | 525.82 | 524.31 | 522.86 | | 150 day SMA | 503.31 | 502.78 | 502.22 | | 200 day SMA | 502.46 | 502.22 | 502 |

|

|