BroadcomInc AVGO full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSIBroadcom Inc AVGO WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI NASDAQ stock exchange

operates under Technology sector & deals in Semiconductors

Daily price and charts and targets BroadcomInc Strong Daily Stock price targets for BroadcomInc AVGO are 340.94 and 349.99 | Daily Target 1 | 333.76 | | Daily Target 2 | 339.06 | | Daily Target 3 | 342.81333333333 | | Daily Target 4 | 348.11 | | Daily Target 5 | 351.86 |

Daily price and volume Broadcom Inc

| Date |

Closing |

Open |

Range |

Volume |

Thu 23 October 2025 |

344.35 (1.12%) |

342.00 |

337.52 - 346.57 |

0.263 times |

Wed 22 October 2025 |

340.53 (-0.62%) |

346.98 |

335.51 - 349.00 |

0.4088 times |

Tue 21 October 2025 |

342.66 (-1.86%) |

350.00 |

341.31 - 351.10 |

0.8749 times |

Mon 20 October 2025 |

349.16 (-0.24%) |

351.98 |

347.84 - 356.59 |

0.369 times |

Fri 17 October 2025 |

349.99 (-0.68%) |

346.05 |

340.78 - 353.09 |

0.7162 times |

Thu 16 October 2025 |

352.38 (0.3%) |

356.00 |

349.49 - 363.24 |

0.7942 times |

Wed 15 October 2025 |

351.33 (2.09%) |

354.47 |

347.50 - 359.40 |

1.3003 times |

Tue 14 October 2025 |

344.13 (-3.52%) |

350.13 |

339.65 - 350.67 |

1.2003 times |

Mon 13 October 2025 |

356.70 (9.88%) |

352.77 |

343.52 - 359.38 |

2.4999 times |

Fri 10 October 2025 |

324.63 (-5.91%) |

345.39 |

324.05 - 350.60 |

1.5734 times |

Thu 09 October 2025 |

345.02 (-0.14%) |

345.75 |

340.40 - 347.31 |

0.9592 times |

Weekly price and charts BroadcomInc Strong weekly Stock price targets for BroadcomInc AVGO are 329.39 and 350.47 | Weekly Target 1 | 324.4 | | Weekly Target 2 | 334.38 | | Weekly Target 3 | 345.48333333333 | | Weekly Target 4 | 355.46 | | Weekly Target 5 | 366.56 |

Weekly price and volumes for Broadcom Inc

| Date |

Closing |

Open |

Range |

Volume |

Thu 23 October 2025 |

344.35 (-1.61%) |

351.98 |

335.51 - 356.59 |

0.3386 times |

Fri 17 October 2025 |

349.99 (7.81%) |

352.77 |

339.65 - 363.24 |

1.1508 times |

Fri 10 October 2025 |

324.63 (-3.88%) |

340.49 |

324.05 - 350.60 |

0.9456 times |

Fri 03 October 2025 |

337.75 (0.96%) |

336.00 |

324.50 - 347.61 |

0.8167 times |

Fri 26 September 2025 |

334.53 (-3.02%) |

342.42 |

327.30 - 346.67 |

1.0318 times |

Fri 19 September 2025 |

344.94 (-4.15%) |

359.87 |

336.43 - 365.69 |

1.4177 times |

Fri 12 September 2025 |

359.87 (7.46%) |

342.75 |

335.83 - 374.23 |

1.7572 times |

Fri 05 September 2025 |

334.89 (12.61%) |

289.34 |

287.17 - 356.34 |

1.42 times |

Fri 29 August 2025 |

297.39 (0%) |

307.01 |

293.66 - 307.01 |

0.2076 times |

Fri 29 August 2025 |

297.39 (1.15%) |

292.81 |

291.71 - 311.00 |

0.9141 times |

Fri 22 August 2025 |

294.00 (-4.03%) |

302.70 |

281.87 - 306.17 |

0.8618 times |

Monthly price and charts BroadcomInc Strong monthly Stock price targets for BroadcomInc AVGO are 334.2 and 373.39 | Monthly Target 1 | 304.69 | | Monthly Target 2 | 324.52 | | Monthly Target 3 | 343.88 | | Monthly Target 4 | 363.71 | | Monthly Target 5 | 383.07 |

Monthly price and volumes Broadcom Inc

| Date |

Closing |

Open |

Range |

Volume |

Thu 23 October 2025 |

344.35 (4.38%) |

328.14 |

324.05 - 363.24 |

0.5832 times |

Tue 30 September 2025 |

329.91 (10.94%) |

289.34 |

287.17 - 374.23 |

1.2313 times |

Fri 29 August 2025 |

297.39 (1.26%) |

286.54 |

281.61 - 317.35 |

0.743 times |

Thu 31 July 2025 |

293.70 (6.55%) |

274.40 |

262.66 - 306.95 |

0.7323 times |

Mon 30 June 2025 |

275.65 (13.87%) |

243.25 |

241.11 - 277.70 |

1.0234 times |

Fri 30 May 2025 |

242.07 (25.77%) |

198.14 |

195.94 - 246.07 |

0.7889 times |

Wed 30 April 2025 |

192.47 (14.96%) |

166.37 |

138.10 - 193.37 |

1.3014 times |

Mon 31 March 2025 |

167.43 (-16.05%) |

204.00 |

160.62 - 204.06 |

1.3555 times |

Fri 28 February 2025 |

199.43 (-9.87%) |

215.46 |

193.15 - 237.93 |

0.8951 times |

Fri 31 January 2025 |

221.27 (-4.44%) |

236.15 |

196.23 - 249.59 |

1.3459 times |

Tue 31 December 2024 |

231.54 (40.55%) |

178.95 |

169.73 - 251.88 |

1.5566 times |

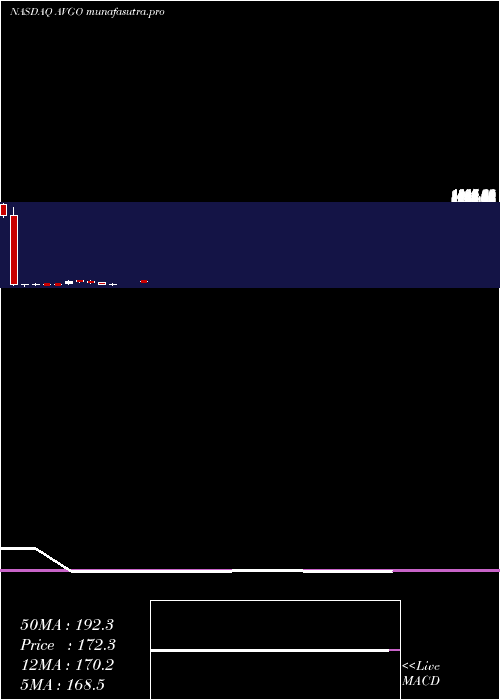

DMA SMA EMA moving averages of Broadcom Inc AVGO

DMA (daily moving average) of Broadcom Inc AVGO

| DMA period | DMA value | | 5 day DMA | 345.34 | | 12 day DMA | 345.53 | | 20 day DMA | 341.05 | | 35 day DMA | 344.03 | | 50 day DMA | 330.51 | | 100 day DMA | 303.3 | | 150 day DMA | 267.4 | | 200 day DMA | 254.48 | EMA (exponential moving average) of Broadcom Inc AVGO

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 344.58 | 344.7 | 346.79 | | 12 day EMA | 344.31 | 344.3 | 344.99 | | 20 day EMA | 342.52 | 342.33 | 342.52 | | 35 day EMA | 335.85 | 335.35 | 335.04 | | 50 day EMA | 330.14 | 329.56 | 329.11 |

SMA (simple moving average) of Broadcom Inc AVGO

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 345.34 | 346.94 | 349.1 | | 12 day SMA | 345.53 | 344.87 | 344.4 | | 20 day SMA | 341.05 | 340.64 | 340.58 | | 35 day SMA | 344.03 | 342.93 | 341.84 | | 50 day SMA | 330.51 | 329.85 | 329.22 | | 100 day SMA | 303.3 | 302.28 | 301.3 | | 150 day SMA | 267.4 | 266.41 | 265.39 | | 200 day SMA | 254.48 | 253.9 | 253.38 |

|

|