6Month M6LL full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSI6 Month M6LL WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI INDICES stock exchange

Daily price and charts and targets 6Month Strong Daily Stock price targets for 6Month M6LL are 54 and 54 | Daily Target 1 | 54 | | Daily Target 2 | 54 | | Daily Target 3 | 54 | | Daily Target 4 | 54 | | Daily Target 5 | 54 |

Daily price and volume 6 Month

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

54.00 (-49.06%) |

54.00 |

54.00 - 54.00 |

0.9768 times |

Wed 03 December 2025 |

106.00 (-6.19%) |

106.00 |

106.00 - 106.00 |

0.9743 times |

Tue 02 December 2025 |

113.00 (48.68%) |

113.00 |

113.00 - 113.00 |

0.9988 times |

Mon 01 December 2025 |

76.00 (111.11%) |

76.00 |

76.00 - 76.00 |

1.0264 times |

Fri 28 November 2025 |

36.00 (-30.77%) |

36.00 |

36.00 - 36.00 |

0.9622 times |

Wed 26 November 2025 |

52.00 (-43.48%) |

52.00 |

52.00 - 52.00 |

0.9914 times |

Tue 25 November 2025 |

92.00 (-38.67%) |

92.00 |

92.00 - 92.00 |

1.0038 times |

Mon 24 November 2025 |

150.00 (-64.37%) |

150.00 |

150.00 - 150.00 |

1.0382 times |

Fri 21 November 2025 |

421.00 (-0.94%) |

421.00 |

421.00 - 421.00 |

1.0301 times |

Thu 20 November 2025 |

425.00 (24.27%) |

425.00 |

425.00 - 425.00 |

0.9982 times |

Wed 19 November 2025 |

342.00 (-13.64%) |

342.00 |

342.00 - 342.00 |

1.0174 times |

Weekly price and charts 6Month Strong weekly Stock price targets for 6Month M6LL are 24.5 and 83.5 | Weekly Target 1 | 14.67 | | Weekly Target 2 | 34.33 | | Weekly Target 3 | 73.666666666667 | | Weekly Target 4 | 93.33 | | Weekly Target 5 | 132.67 |

Weekly price and volumes for 6 Month

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

54.00 (50%) |

76.00 |

54.00 - 113.00 |

1.5845 times |

Fri 28 November 2025 |

36.00 (-91.45%) |

150.00 |

36.00 - 150.00 |

1.5922 times |

Fri 21 November 2025 |

421.00 (17.6%) |

398.00 |

342.00 - 425.00 |

2.0259 times |

Fri 14 November 2025 |

358.00 (104.57%) |

123.00 |

122.00 - 358.00 |

1.9888 times |

Fri 07 November 2025 |

175.00 (-54.19%) |

175.00 |

175.00 - 175.00 |

0.2295 times |

Fri 07 November 2025 |

382.00 (27.33%) |

59.00 |

59.00 - 382.00 |

0.6336 times |

Thu 06 November 2025 |

300.00 (33.33%) |

92.00 |

92.00 - 300.00 |

0.6498 times |

Wed 05 November 2025 |

225.00 (-21.88%) |

130.00 |

130.00 - 225.00 |

0.6516 times |

Tue 04 November 2025 |

288.00 (311.43%) |

288.00 |

288.00 - 288.00 |

0.4079 times |

Fri 31 October 2025 |

70.00 (-55.97%) |

70.00 |

70.00 - 70.00 |

0.2362 times |

Fri 31 October 2025 |

159.00 (127.14%) |

159.00 |

159.00 - 159.00 |

0.4022 times |

Monthly price and charts 6Month Strong monthly Stock price targets for 6Month M6LL are 24.5 and 83.5 | Monthly Target 1 | 14.67 | | Monthly Target 2 | 34.33 | | Monthly Target 3 | 73.666666666667 | | Monthly Target 4 | 93.33 | | Monthly Target 5 | 132.67 |

Monthly price and volumes 6 Month

| Date |

Closing |

Open |

Range |

Volume |

Thu 04 December 2025 |

54.00 (50%) |

76.00 |

54.00 - 113.00 |

0.195 times |

Fri 28 November 2025 |

36.00 (-48.57%) |

288.00 |

36.00 - 425.00 |

1.0064 times |

Fri 31 October 2025 |

70.00 (-11.39%) |

52.00 |

9.00 - 200.00 |

1.6599 times |

Tue 30 September 2025 |

79.00 (41.07%) |

89.00 |

31.00 - 102.00 |

1.0343 times |

Fri 29 August 2025 |

56.00 (-55.2%) |

181.00 |

31.00 - 181.00 |

1.0218 times |

Thu 31 July 2025 |

125.00 (62.34%) |

61.00 |

14.00 - 125.00 |

1.0648 times |

Mon 30 June 2025 |

77.00 (-11.49%) |

89.00 |

33.00 - 138.00 |

0.9319 times |

Fri 30 May 2025 |

87.00 (-2.25%) |

59.00 |

42.00 - 118.00 |

1.1311 times |

Wed 30 April 2025 |

89.00 (-83.99%) |

452.00 |

35.00 - 1094.00 |

1.0145 times |

Mon 31 March 2025 |

556.00 (54.44%) |

462.00 |

100.00 - 614.00 |

0.9403 times |

Fri 28 February 2025 |

360.00 (260%) |

206.00 |

77.00 - 360.00 |

0.9246 times |

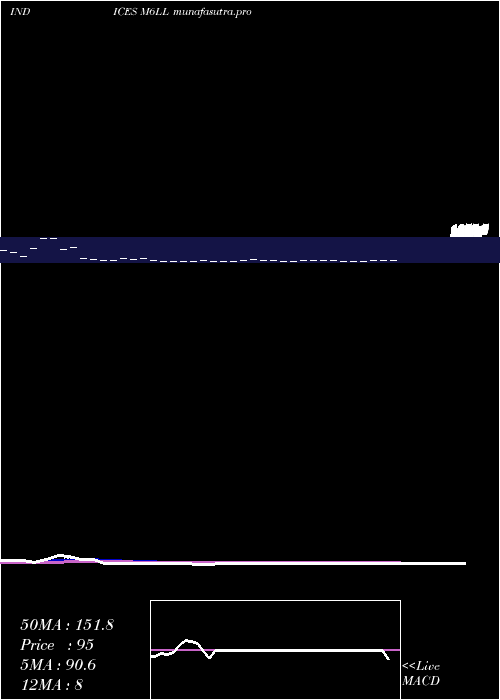

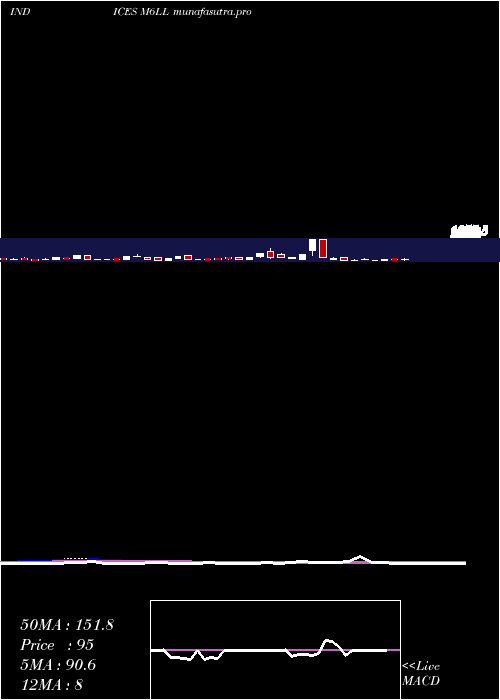

DMA SMA EMA moving averages of 6 Month M6LL

DMA (daily moving average) of 6 Month M6LL

| DMA period | DMA value | | 5 day DMA | 77 | | 12 day DMA | 188.58 | | 20 day DMA | 211.7 | | 35 day DMA | 185.31 | | 50 day DMA | 146.96 | | 100 day DMA | 104.71 | | 150 day DMA | 90.86 | | 200 day DMA | 116.91 | EMA (exponential moving average) of 6 Month M6LL

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 91.04 | 109.55 | 111.33 | | 12 day EMA | 143.21 | 159.42 | 169.13 | | 20 day EMA | 165.23 | 176.93 | 184.39 | | 35 day EMA | 159.47 | 165.68 | 169.19 | | 50 day EMA | 132.35 | 135.55 | 136.76 |

SMA (simple moving average) of 6 Month M6LL

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 77 | 76.6 | 73.8 | | 12 day SMA | 188.58 | 217.25 | 238.25 | | 20 day SMA | 211.7 | 211.95 | 221.65 | | 35 day SMA | 185.31 | 186.43 | 183.8 | | 50 day SMA | 146.96 | 146.18 | 145.9 | | 100 day SMA | 104.71 | 105.2 | 105.17 | | 150 day SMA | 90.86 | 90.94 | 90.87 | | 200 day SMA | 116.91 | 118.18 | 118.77 |

|

|