Sbc 542725 full analysis,charts,indicators,moving averages,SMA,DMA,EMA,ADX,MACD,RSISbc 542725 WideScreen charts, DMA,SMA,EMA technical analysis, forecast prediction, by indicators ADX,MACD,RSI,CCI BSE stock exchange

Daily price and charts and targets Sbc Strong Daily Stock price targets for Sbc 542725 are 27.24 and 27.92 | Daily Target 1 | 26.68 | | Daily Target 2 | 27.12 | | Daily Target 3 | 27.36 | | Daily Target 4 | 27.8 | | Daily Target 5 | 28.04 |

Daily price and volume Sbc

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

27.56 (2.45%) |

26.97 |

26.92 - 27.60 |

2.1135 times |

Thu 04 December 2025 |

26.90 (0.94%) |

26.01 |

26.01 - 27.15 |

1.3941 times |

Wed 03 December 2025 |

26.65 (-0.41%) |

26.30 |

26.30 - 26.91 |

0.3435 times |

Tue 02 December 2025 |

26.76 (-0.96%) |

27.00 |

26.46 - 27.25 |

0.402 times |

Mon 01 December 2025 |

27.02 (1.81%) |

26.80 |

26.24 - 27.25 |

0.6865 times |

Fri 28 November 2025 |

26.54 (2.67%) |

25.70 |

25.68 - 26.66 |

0.3878 times |

Thu 27 November 2025 |

25.85 (0.35%) |

26.00 |

25.44 - 26.25 |

2.1023 times |

Wed 26 November 2025 |

25.76 (-1.49%) |

26.25 |

25.57 - 26.25 |

0.5321 times |

Tue 25 November 2025 |

26.15 (0.46%) |

27.00 |

25.44 - 27.00 |

1.8126 times |

Mon 24 November 2025 |

26.03 (-1.1%) |

26.14 |

25.80 - 26.45 |

0.2256 times |

Fri 21 November 2025 |

26.32 (0%) |

26.57 |

26.10 - 26.59 |

0.3182 times |

Weekly price and charts Sbc Strong weekly Stock price targets for Sbc 542725 are 26.79 and 28.38 | Weekly Target 1 | 25.47 | | Weekly Target 2 | 26.51 | | Weekly Target 3 | 27.056666666667 | | Weekly Target 4 | 28.1 | | Weekly Target 5 | 28.65 |

Weekly price and volumes for Sbc

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

27.56 (3.84%) |

26.80 |

26.01 - 27.60 |

1.4256 times |

Fri 28 November 2025 |

26.54 (0.84%) |

26.14 |

25.44 - 27.00 |

1.4605 times |

Fri 21 November 2025 |

26.32 (6.82%) |

24.60 |

24.57 - 26.78 |

1.3646 times |

Fri 14 November 2025 |

24.64 (0.57%) |

25.54 |

24.57 - 26.03 |

0.9226 times |

Fri 07 November 2025 |

24.50 (2.51%) |

24.38 |

23.90 - 25.47 |

0.8296 times |

Fri 31 October 2025 |

23.90 (1.88%) |

23.38 |

21.50 - 24.07 |

1.0517 times |

Thu 23 October 2025 |

23.46 (1.03%) |

23.30 |

22.54 - 23.56 |

0.2584 times |

Fri 17 October 2025 |

23.22 (2.07%) |

22.68 |

22.11 - 23.39 |

0.7691 times |

Fri 10 October 2025 |

22.75 (2.8%) |

22.57 |

22.01 - 23.20 |

1.0331 times |

Fri 03 October 2025 |

22.13 (2.08%) |

21.99 |

21.14 - 22.79 |

0.8849 times |

Fri 26 September 2025 |

21.68 (1.45%) |

21.34 |

21.21 - 22.05 |

0.4131 times |

Monthly price and charts Sbc Strong monthly Stock price targets for Sbc 542725 are 26.79 and 28.38 | Monthly Target 1 | 25.47 | | Monthly Target 2 | 26.51 | | Monthly Target 3 | 27.056666666667 | | Monthly Target 4 | 28.1 | | Monthly Target 5 | 28.65 |

Monthly price and volumes Sbc

| Date |

Closing |

Open |

Range |

Volume |

Fri 05 December 2025 |

27.56 (3.84%) |

26.80 |

26.01 - 27.60 |

0.2895 times |

Fri 28 November 2025 |

26.54 (11.05%) |

24.38 |

23.90 - 27.00 |

0.9294 times |

Fri 31 October 2025 |

23.90 (10.96%) |

21.14 |

21.14 - 24.07 |

0.7449 times |

Tue 30 September 2025 |

21.54 (12.83%) |

19.24 |

19.04 - 22.39 |

0.7453 times |

Fri 29 August 2025 |

19.09 (9.84%) |

17.40 |

15.82 - 19.49 |

0.8296 times |

Thu 31 July 2025 |

17.38 (18.47%) |

14.76 |

14.49 - 18.03 |

1.0555 times |

Mon 30 June 2025 |

14.67 (-1.08%) |

14.85 |

14.26 - 16.30 |

1.3782 times |

Fri 30 May 2025 |

14.83 (11.34%) |

13.38 |

13.00 - 15.30 |

1.5223 times |

Wed 30 April 2025 |

13.32 (5.71%) |

12.61 |

12.33 - 15.50 |

1.1114 times |

Fri 28 March 2025 |

12.60 (-36.62%) |

19.86 |

12.00 - 21.22 |

1.3938 times |

Fri 28 February 2025 |

19.88 (-9.92%) |

21.37 |

16.54 - 22.66 |

0.7303 times |

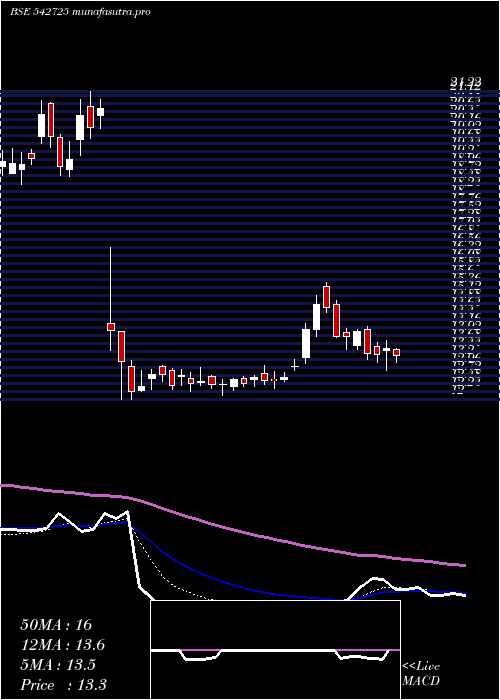

DMA SMA EMA moving averages of Sbc 542725

DMA (daily moving average) of Sbc 542725

| DMA period | DMA value | | 5 day DMA | 26.98 | | 12 day DMA | 26.49 | | 20 day DMA | 25.9 | | 35 day DMA | 24.88 | | 50 day DMA | 24.04 | | 100 day DMA | 21.33 | | 150 day DMA | 19.05 | | 200 day DMA | 18.29 | EMA (exponential moving average) of Sbc 542725

| EMA period | EMA current | EMA prev | EMA prev2 | | 5 day EMA | 26.97 | 26.68 | 26.57 | | 12 day EMA | 26.45 | 26.25 | 26.13 | | 20 day EMA | 25.94 | 25.77 | 25.65 | | 35 day EMA | 25.03 | 24.88 | 24.76 | | 50 day EMA | 24.14 | 24 | 23.88 |

SMA (simple moving average) of Sbc 542725

| SMA period | SMA current | SMA prev | SMA prev2 | | 5 day SMA | 26.98 | 26.77 | 26.56 | | 12 day SMA | 26.49 | 26.33 | 26.17 | | 20 day SMA | 25.9 | 25.78 | 25.64 | | 35 day SMA | 24.88 | 24.75 | 24.63 | | 50 day SMA | 24.04 | 23.92 | 23.81 | | 100 day SMA | 21.33 | 21.2 | 21.09 | | 150 day SMA | 19.05 | 18.95 | 18.86 | | 200 day SMA | 18.29 | 18.25 | 18.23 |

|

|